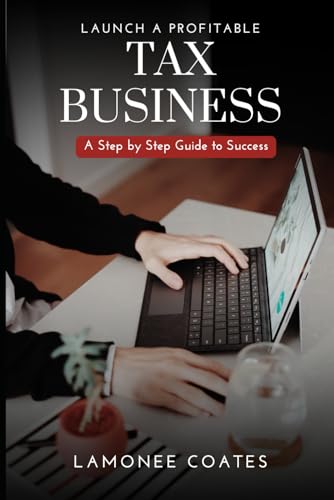

Ready to launch your own successful tax business? Lamonee Coates' "Launching A Profitable Tax Business" provides a comprehensive guide for both seasoned professionals and aspiring entrepreneurs. This eBook walks you through every stage, from navigating legal requirements and obtaining necessary certifications (PTIN, EFIN) to selecting the optimal business structure and leveraging effective marketing strategies. Learn about essential software tools, stay updated on current tax laws, and discover the benefits of remote work. Coates offers practical advice and industry insights to build client trust and establish a thriving, long-term practice. Build a solid foundation for financial success in the competitive tax preparation field.

Review Launching A Profitable Tax Business

Okay, let me tell you about my experience with "Launching a Profitable Tax Business" by Lamonee Coates. Honestly, I was blown away! Going into it, I knew I wanted to learn more about starting my own tax business, but I had no idea just how much was involved. This book truly opened my eyes to the sheer amount of planning and preparation needed to build a successful and sustainable venture. It's not just about knowing taxes – though the book certainly covers that extensively – it's about the entire business ecosystem.

What struck me most was how comprehensive it is. Coates doesn't just skim the surface; she dives deep into the nitty-gritty details. From the very first steps of securing the necessary licenses and certifications (like that IRS PTIN or EFIN – something I never even knew existed!), to choosing the right business structure, she walks you through every crucial decision. The book really emphasized the importance of legal compliance and understanding the ins and outs of tax law, which is absolutely vital for building a trustworthy reputation. And it's not just about the boring legal stuff; she makes it engaging and understandable, breaking down complex topics into manageable chunks.

One thing that really impressed me was the focus on practical tools and software. I always knew technology was important, but the book helped me understand which tools are essential and how they can streamline my workflow. This wasn't just a list; Coates explains how to effectively use these resources to work smarter, not harder – a phrase that resonated deeply with me. The book actually saved me hours of frustrating online searches trying to figure out what software best fits my needs. It's the kind of time-saving insight that's invaluable when you're building a business from scratch.

Beyond the technical aspects, the book delves into the crucial area of marketing and client acquisition. Building trust with clients is paramount in the tax business, and Coates provides some really insightful strategies to help you attract and retain clients. She offers actionable advice, covering everything from networking to building a professional online presence. The book also addresses the exciting possibilities of remote work and how to leverage those opportunities. I especially appreciated her tips on navigating the ever-changing landscape of tax laws; the book acknowledges that it’s a dynamic field and equips you with the knowledge to stay updated.

In short, “Launching a Profitable Tax Business” isn't just a guide; it's a comprehensive roadmap to success. It's a must-read for anyone, whether you're a seasoned tax professional looking to expand your business or a complete beginner taking those first tentative steps. It filled in so many knowledge gaps I didn't even realize I had, and left me feeling confident and prepared to tackle the challenges of starting my own tax business. If you're serious about entering this field, do yourself a favor and pick up this book – you won't regret it! The depth of information provided is truly remarkable, and the clarity of the writing makes even complex topics easy to understand. It’s a fantastic investment in your future.

Information

- Dimensions: 6 x 0.15 x 9 inches

- Language: English

- Print length: 60

- Publication date: 2024

Preview Book